The Global Status of 5G Solutions and 5G Deployments

In March, RCR Wireless News issued an in-depth overview of the state of 5G deployments worldwide entitled What’s the Status of 5G Globally? The report covered major developments in the 5G ecosystem, including adoption rates, impediments to 5G rollouts, device availability, statics on specific regions, and more. A key takeaway is that everything surrounding adoption — from successful 5G deployments to the rate of service rollouts and scale — depends on the specific policies of a given country and the technologies utilized by their mobile service providers.

Such an environment makes it difficult to provide a true, apples-to-apples comparison of 5G solutions on a global scale. Regardless, it was noted that, around the world, 5G deployments are primarily driven by the need for additional digital capacity and/or the need to drive down costs via network virtualization.

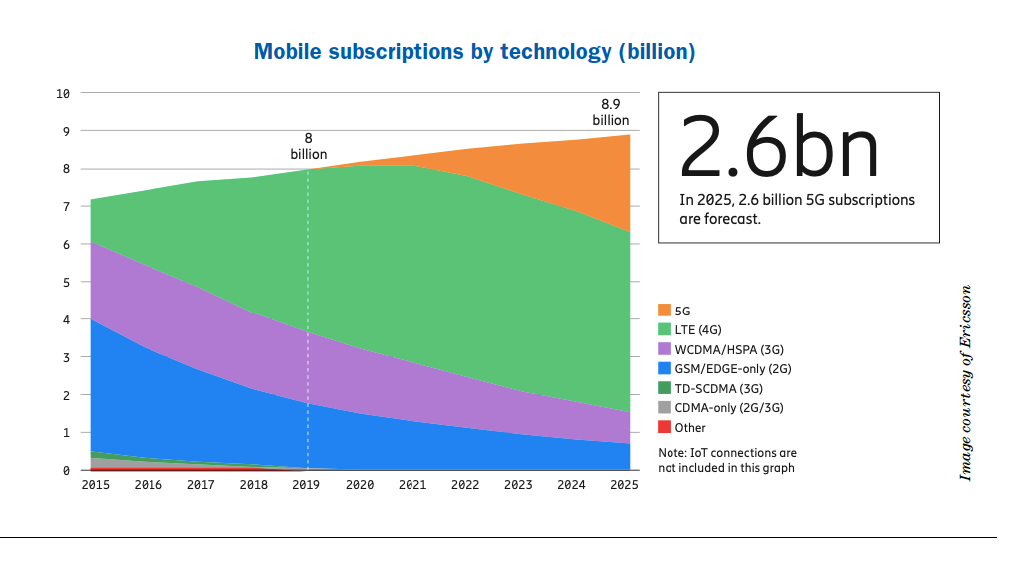

To get started, let’s look at some big-picture global subscription trends:

The latest Ericsson Mobility Report claims there will be 13M mobile subscribers by the end of 2020 vs. a projected 2.6B by 2025. As of this writing, 5G mobile networks have been deployed across 378 cities in 34 countries.

The latest Ericsson Mobility Report claims there will be 13M mobile subscribers by the end of 2020 vs. a projected 2.6B by 2025. As of this writing, 5G mobile networks have been deployed across 378 cities in 34 countries.

Key Issues Impacting 5G Deployments: Policies and Spectrum

Government guidelines and regulations regarding infrastructure policies, the allocation of 5G spectrum licenses, and zoning — on both local and national levels — shape the environment in which mobile service providers have to operate. The successful build-out of infrastructure (e.g., cell installations/towers) depends heavily on how supportive that environment is in terms of the regulatory landscape. Lengthy right-of-way hearings, zoning approval cycles and exorbitant application fees can severely delay the rollout of necessary infrastructure. And the lack of uniformity among federal, state, and local regulations only compounds the complexity confronting prospective 5G network build-outs.

While the regulatory environment has a major impact on the growth of 5G, the availability of spectrum is the key factor throttling the speed of 5G rollouts across various countries. Some nations are aggressively opening the frequency spectrum for 5G, while others take a more circumspect approach. Additionally, 5G rollouts are more complex than previous generations of wireless communications technologies because the 5G frequency spectrum is in fact divided into three distinct deployments: high-band (millimeter waves), mid-band, and low-band.

Low-band uses a similar frequency range as 4G and offers a similar capacity, while millimeter wave is the fastest with frequencies ranging from 24 GHz to 72 GHz. With frequencies between 2.4 GHz and 4.2 GHz, mid-band is the most widely deployed (30+ networks worldwide — Sprint and China Mobile use 2.5 GHz).

Mid-band networks have good reach and coverage can be extended by upgrading existing towers, making them more cost-effective. As a rule of thumb, low-band provides the best coverage and high-band is the fastest. Mid-band provides the best of both worlds: better coverage than millimeter waves and adequate spectrum availability to reach most of the speed promised by 5G. For this reason, mid-band is considered the ideal deployment.

5G Deployments — Regional Highlights

The RCR Wireless News report covers 5G solutions across several regions worldwide, with a major emphasis on comparing the world’s 5G technology leaders — the U.S. (North America) and China.

North America and China:

- North America leads in innovation, offering more flavors of 5G and more innovative technologies.

- China leads in ready-to-deploy. It has already opened the mid-band spectrum and has the infrastructure to leverage 5G’s “sweet spot.” In contrast, the U.S. has primarily low-band and high-band deployments, with mid-band openings not expected until 2021. In the US, mobile service providers T-Mobile and AT&T launched low-band services (600 and 580 MHz, respectively) in December 2019, which offer performance that is not significantly greater than a robust 4G in the same spectrum.

- China leads in network convergence, slicing, and virtualization. The Chinese decided to deploy standalone, native 5G solutions from the start, which is critical for achieving low latency. On the other hand, the U.S. opted for a non-standalone approach (i.e., evolving up from 4G to 5G) to protect 4G investments. On the upside, this approach is less costly than building out a standalone network and delivers a faster time-to-market.

South Korea:

- Leads the world in number of cities with 5G service

- Accounted for 77 percent of global 5G users (June 2019)

- Launched limited 5G commercial services in December 2018, rolled out nationwide 5G (3.5 GHz mid-band) in April 2019

- Has three 5G carriers, the largest of which (SK Telecom, an A10 Networks customer) is expected to roll out standalone 5G this year

Australia, India, and South Africa:

- Australia has allocated 5G spectrum to four major mobile service providers that currently offer 39 sites with commercial 5G availability.

- India’s 5G rollout has been delayed considerably due to high prices at the nation’s spectrum auctions. The cellular situation remains uncertain as the number of people with data plans is still a small percentage of mobile users (India is heavy on Wi-Fi usage).

- South Africa is the most advanced market in Sub-Saharan Africa, boasting the most 5G activity. However, mass deployment is years away due to the high cost of infrastructure. Projections call for 120M subscribers by 2025, with access coming most via 5G fixed wireless access points acting as hotspots.

What about Europe?

While RCR Wireless News didn’t focus on the EU, per se, some observations can be made in light of recent developments:

- In the wake of the global COVID-19 pandemic, many nations are reevaluating their relationship with China, particularly as it pertains to the use of Huawei technologies in their 5G infrastructure. The UK has been especially vocal about its concerns with Huawei.

- The coronavirus has also brought out a growing number of conspiracy theories linking 5G mobile networks to the rise of the pandemic, as well as to cancer. According to a recent report (Times of Israel, April 21, 2020), some 50 fires targeting cell towers and other equipment were reported in Britain in April. Sixteen towers have also been torched in the Netherlands, with additional attacks reported in Ireland, Cyprus, and Belgium. Clearly, such developments can have a significant impact on the rollout of 5G on the continent.

5G Security, Device, and Infrastructure Developments

Large-scale adoption of 5G can’t happen without the availability of compatible equipment (smartphones, routers, customer premises equipment, and fixed wireless terminals). Fortunately, output of the “right stuff” is picking up rapidly. According to the Ericsson Mobility Report, compatible handset device volumes are forecast to hit 160M units as China continues its expansion of 5G coverage. By 2021, it’s projected that all Chinese manufactured handsets will support 5G. Even India, without any functioning 5G networks, has 5G phones for sale — after all, they work just fine on a 4G network. Industry analysts assert that, before long, every modem on the market will support 5G. Other highlights in this area include:

- The availability of 5G devices is scaling up much faster the previous generations. 5G has already outpaced the launching of LTE devices at the time of the rollout of 4G.

- First-generation 5G phones are basically 3G/4G handsets with a 5G radio.

- Next-generation 5G phones with second-generation chips will deliver a substantial performance boost when introduced later this year.

- Next-generation devices will cost more than phones that are not future-proofed for 5G compatibility.

- The availability of affordable handsets will have a direct impact on subscriptions, and thus spur the growth of 5G networks.

- China is pushing the development of affordable 5G phones, while the U.S., for now, is focused on the premium market. Don’t expect any low-priced U.S. options in 2020, although the U.S. will have more 5G subscriptions than 4G by 2022.

- In 2020 we will also see growth in 5G-compatible customer-premises equipment (CPE), fixed wireless terminals (FWT), and pocket routers, accelerating the implementation of 5G-enabled homes.